May 8, 2009

Paracatu-MG, Brazil

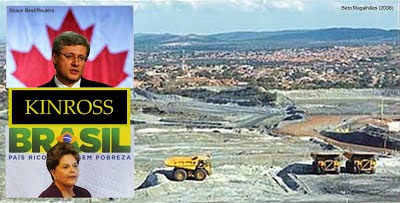

“Not now, thanks” (said Wilson Brumer, former State Secretary, refusing Kinross’ gold)The Canadian Kinross Gold Corporation press release was efficient on spreading the news about Wilson Nelio Brumer to join the company Board of Directors, April this year. It was in the internet all over the world that on May 6, at the Toronto headquarters annual meeting that Brumer was to be voted and appointed.

Just two days passed on and “O Tempo”, a local Brazilian newspaper, in a now timid note headlined “Refusing Gold” quoted Wilson Brumer, a former Minas Gerais State Secretary, as being more interested to run his own business.

Brumer´s to be appointment had been interpreted as Kinross desperate try to place its Brazilian operation in the hands of someone with “easy transit and flow” within Government offices, someone with a known track record to sell valuable Brazilian assets to foreign groups. Kinross makes it public in its “Code of Ethics“ that “facilition payments” are due to government authorities in order to facilitate businesses in foreign countries.

Bottlenecked twice by two legal suits which prevent Kinross to build up a gigantic toxic tailings dam in the outskirts of the historical city of Paracatu, the mining company threatened to close doors at the beginning of this month. Sergio Dani, an M.D., PhD who presides the Acangau Foundation, a Brazilian non governmental foundation fighting a two-year long struggle to make Kinross pay for its debts in Paracatu said “the company representatives are crying crocodile tears as no company gets out of business for technical problems but rather for sheer incompetence”.

Kinross mining rights in Paracatu were bought in 2006 from Rio Tinto, one of the biggest in the mining sector, for just US $280 million – “a bargain” in the words of geologist Eupidio Reis, surprised by such a low amount paid for the Brazilian biggest gold reserve, some 16 million ounces, standing for more than 60% of total Kinross’ proven gold reserves. Eupidio Reis did not understand why the Paracatu mine, estimated in over US $10 billion, could be sold so cheap.

Truth is, what seemed to be a bargain for the Toronto dandies soon proved to be a nightmare. Sergio Dani explains that since 1987 the Paracatu gold mining project has been poorly planned and equally poorly managed, “Kinross invested a half billion dollars to scale up this mine production but all it got back was to make more evident the error, makeshift and blunder surrounding this expansion project” said Dani. The socio-economical and environmental damages lay open wide for anyone to see (see pics and videos at http://alertaparacatu.blogspot.com/ ).

In order to explore the world’s lowest grade ore (0.4 g/ton) the mining company disputes with local population and farmers huge volumes of precious fresh water, giving back in turn millions of tons of toxic debris – deposited into gigantic tailings dams built on the freshwater springs which meant to supply the city 90.000 inhabitants.

The regular mine explosions have been causing cracks in this historical city buildings and houses. One suspects that the toxic dust released from the open pit mine operations is responsible for increasing cancer incidence and other diseases in Paracatu.

The Paracatu mine ore is arsenopyrite which equals to say it liberates arsenic and sulphuric acid into the environment when mined and ground to have gold extracted. Arsenic is a cancer causing substance and sulphuric acid permeates and contaminates streams and groundwater.

Kinross accounting liabilities in Paracatu compete with the value of its gold reserves - bad news for any stockholder. One wonders if any stockholder would knowingly embark into an adventure that poses risk to his/her invested capital? Question is: how much do the stockholders really know about it?

Kinross tries hard to conceal its mistakes and disqualify Paracatu scientific community when offered a sustainable withdraw plan, as of 2007. “We do not tolerate a foreign company to name us as silly and idiots” warned Serrano Neves, Justice Prosecutor and the Fundacao Acangau Council Curator when challenged by the Canadian transnational mining company.

“Paracatu Kinross mining is stuck in stone age. Liabilities are gigantic and the fly-by-night risk are substancial”, adds Dani. “It comes as a “no surprise” that Mr. Brumer has refused a return ticket to travel back to the past of mining”, he concluded.

Brumer’s refusal to the invitation to take a seat at the Kinross Board of Directors opens room for speculations. Brumer served in Billinton, the first owner of the Paracatu mining site. Brumer welcomed the Rio Tinto-Kinross expansion project as a Minas Gerais State Secretary. Brumer did not say “ no thanks “ then. Presently, when the opposition to the mine expansion is strong, he appears to say: “Not now, thanks”.

No new director of Kinross Gold Corporation gets less than a US$100,000 monthly salary, plus compensations. Kinross CEO, Tye Burt, for example, has got US$10 million as salary and compensations in 2008. It is hard to tell whether Mr. Brumer would get as much in his own businesses in Brazil.

What has Brumer really refused?

Cylene Gama

Sources:

http://www.reuters.com/article/pressRelease/idUS239069+23-Apr-2009+MW20090423

http://www.otempo.com.br/otempo/colunas/?IdEdicao=1288&IdColunaEdicao=8485

http://www.alertaparacatu.blogspot.com/

http://www.kinross.com/corporate/pdf/management-information-circular.pdf

No comments:

Post a Comment